Chenango County public hearing on budget exceeding tax cap on Monday evening

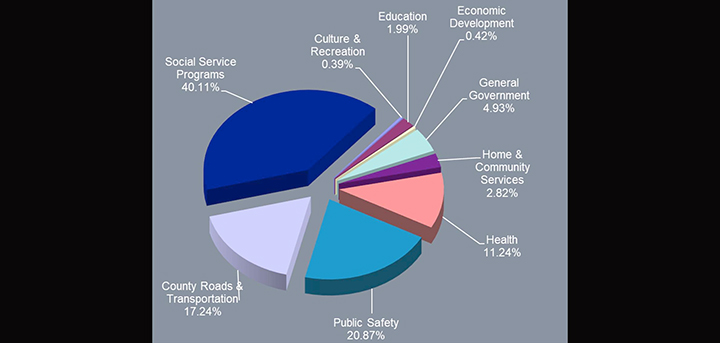

The chart presented by the Chenango County Board of Supervisors shows the proposed Chenango County 2025 property tax rate distribution. (Image from Chenango County)

CHENANGO COUNTY – A public hearing regarding the Chenango County 2025 tentative budget will be held at 5 p.m. on Monday, Nov. 25, in the board meeting room at the County Office Building in Norwich.

The proposed budget exceeds the state-mandated 2.7% tax cap by approximately $397,000, marking the first time in 13 years the county has surpassed the cap.

Officials reported that meeting the cap is crucial for state reimbursement of "Raise the Age" costs; however, exceptions have been granted by New York State for counties that fail to meet this requirement.

Key details of the proposed budget include a 3.38% increase in the average tax rate, translating to an additional $47.32 annually for the average county residence. Individual tax rates for towns and the City of Norwich will vary based on equalization rates and assessed values.

Rising costs for state-mandated programs, exceeding $2.5 million, have significantly impacted the county’s spending trajectory from 2023 to 2025, with further increases expected.

The hearing will provide an opportunity for the public to voice concerns or seek clarification about the budget and its implications. Find more information at https://www.chenangocountyny.gov/251/Budget

Comments